Read next

True Investable Assets by Powerlytics

Wealth Accuracy with 100% US Market Coverage

Read Article

A leading credit card issuer was seeking to expand its highly profitable proactive credit line increase (PCLI) program. Regulatory requirements dictate that prior to proactively increasing a credit line, the card issuer must get the cardholder’s stated income in order to determine their ability to pay. While stated income is typically provided during the application process, it needs to be updated after 12 months which is invasive and very difficult to achieve via customer communication channels.

The card issuer was seeking an alternative income source that would cover a large portion of its cardholders, meet regulatory standards and its own risk requirements, and would not add any customer friction.

Powerlytics True Income which leverages a proprietary database of the tax returns of over 150M US households looked like the ideal solution. It not only covered all of the card issuer’s cardholders but could provide highly accurate household income estimates and score a customer’s stated income with zero customer friction. Moreover, the Office of the Comptroller of the Currency (OCC) had reviewed the solution and allowed commercial usage for line increases and other use cases including prospect targeting and getting to a “yes” in a loan decisioning process.

To evaluate the True Income solution, the card issuer and Powerlytics collaborated on a blind test against verified income to validate that Powerlytics income estimates met the issuer’s strict risk guidelines. The blind test proved successful and the issuer then moved into a production environment that validated that the credit quality of PCLIs from Powerlytics income estimates either improved or stayed consistent with the quality of PCLIs from stated income as follows.

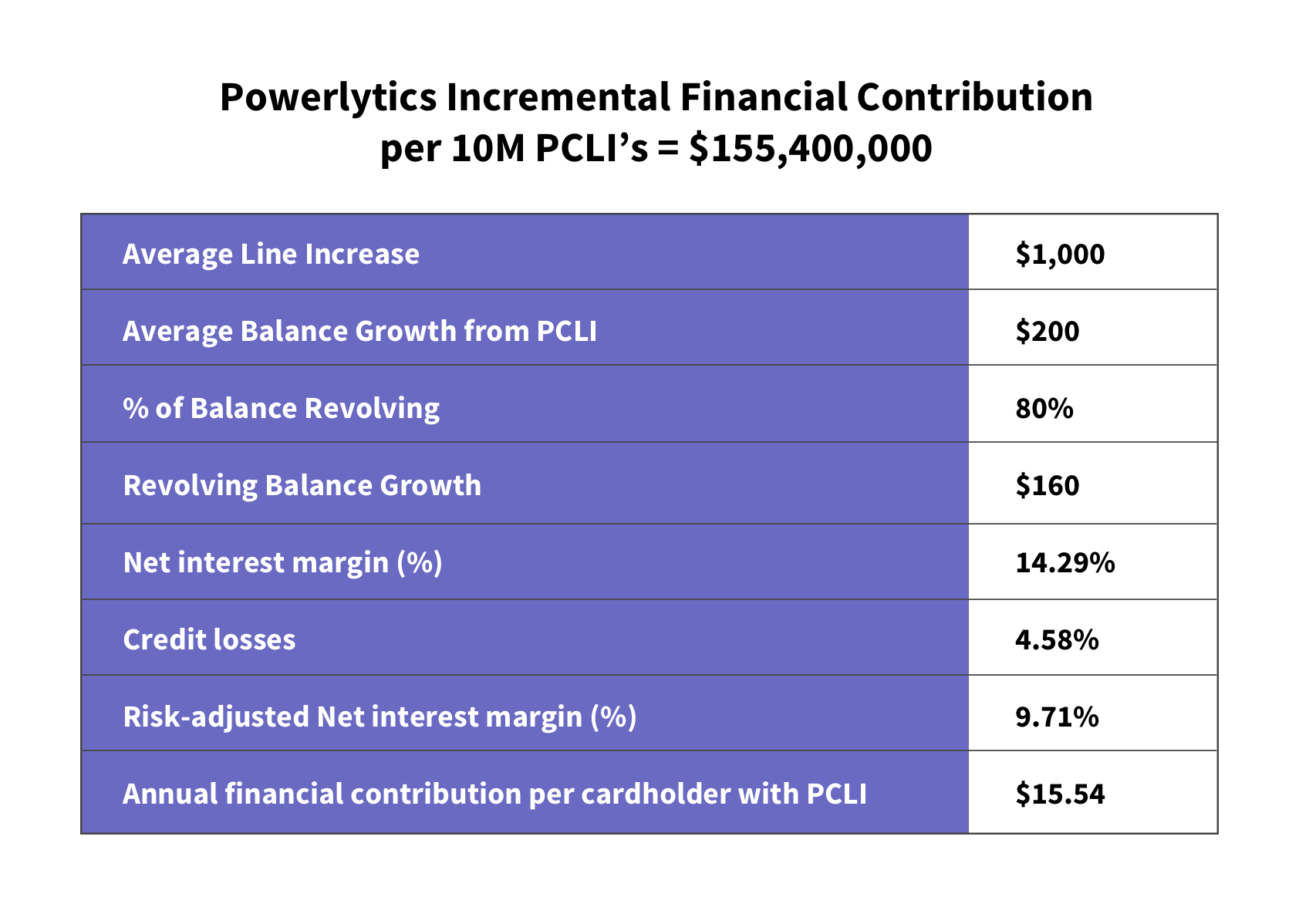

The credit card issuer entered into a multi-year contract with Powerlytics that enabled it to evaluate over 10Ms incremental cardholders annually for PCLIs. By implementing Powerlytics True Income to grow profitable PCLIs, the credit card issuer could improve its annual financial contribution by over $15 per cardholder resulting an incremental financial contribution per 10M PCLIs of $155.4M (see chart below)

In addition, the card issuer can utilize Powerlytics to streamline originations, improve default models and enhance prospect targeting models.

Wealth Accuracy with 100% US Market Coverage

Read Article