Read next

Finding the Optimal Place to do Business

Unparalleled Site Selection Insights

Read Article

When evaluating whether to extend credit, an alternative lender needed an accurate, real time and frictionless way to understand consumer’s ability to pay.

Historically, the lender was forced to choose between two sub-optimal solutions:

Powerlytics worked with the lender to test and implement Powerlytics True Income, a suite of Income Verification and Estimation products that leverage anonymized real income data from over 150M U.S. households and covering over 200M adults.

Based on an individual’s ZIP+4, True Income can:

Key differentiators of True Income:

Reviewed for Use by Regulators – True Income is not a modeled solution but is built by using statistical distributions of anonymized tax filings. As a result, the OCC has provided guidance for marketing, underwriting, and proactive credit line increases.

Covers 100% of US Income Tax Filers – Many other solutions are limited to a narrow range of the population.

Covers All Forms of Income – W2, wealth, retirement, business; other solutions may only cover W2.

Zero Customer Friction – The only information needed is the prospect or customer’s ZIP+4; based on this data alone, Powerlytics can deliver a highly accurate income score or estimate.

Real Time – Powerlytics True Income API suite can offer real time income estimates and verification scores. Batch updates can be fulfilled quickly and efficiently as well.

Customized to Meet Your Needs – Powerlytics can further refine income scores and estimates to meet a client’s unique needs. Scores and estimates can be tailored for homeowners vs. renters and further tuned based on the product offered or segment targeted.

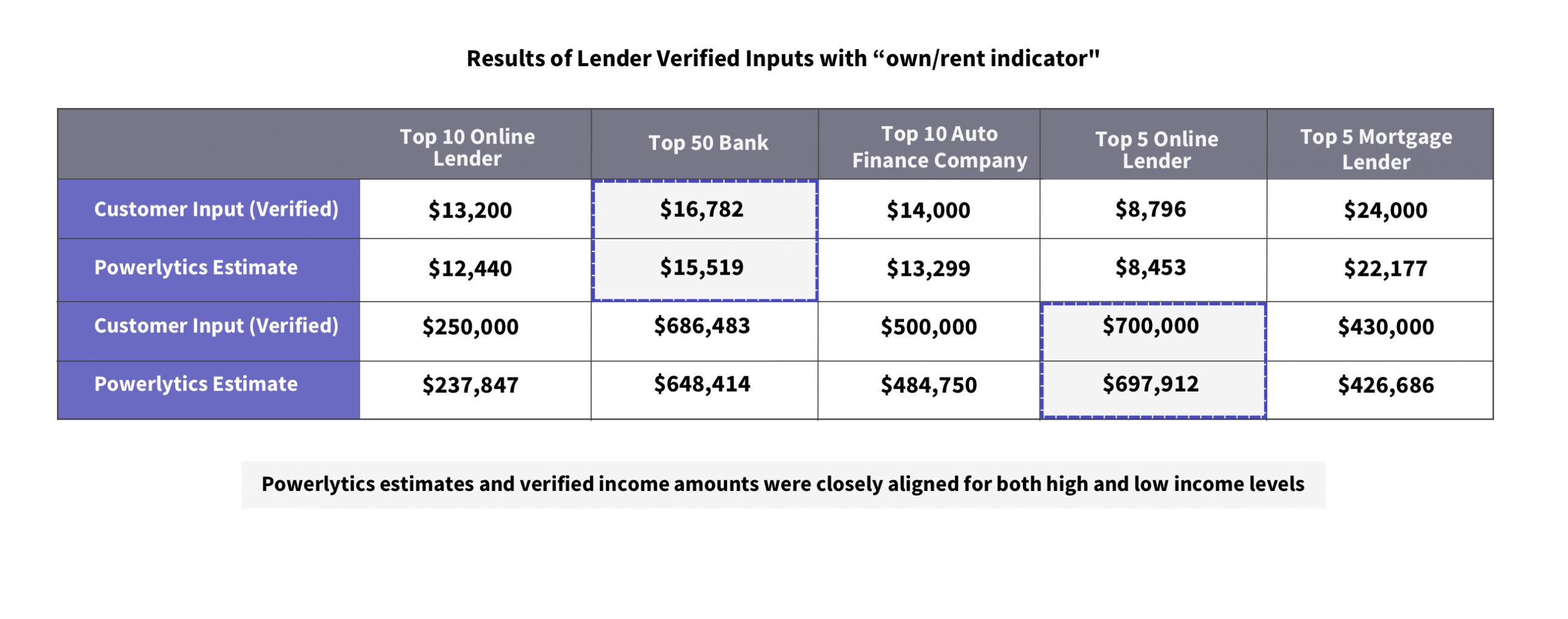

To get the lender comfortable with its income estimates, Powerlytics shared the results of a number of blind tests with banks and lenders where our True Income solution consistently outperformed in-house and third-party income prediction models. Below are the results of blind tests with 5 lenders where the lender shared the encryption key to identify which incomes were verified to evaluate results.

Powerlytics estimates were very close to verified customer income at both low and high income levels.

The lender then went through a live pilot to test Powerlytics True Income against its current vendor and manual verification processes. The results showed that Powerlytics True Income solution surpassed their current vendor and manual efforts on accuracy, timeliness and affordability.

Following the successful pilot and implementation of Powerlytics True Income, the lender can now approve many applicants without requiring an individual to provide access to their bank account or provide W2s, tax returns or other information. This reduced friction has resulted in an improved applicant approval process, increased applicant conversion, while also reducing the lenders application processing costs.

Unparalleled Site Selection Insights

Read Article