Read next

Predicting the Impact of a Downturn

Helping Banks and Lenders Improve Portfolio Risk Analysis in a Recession

Read Article

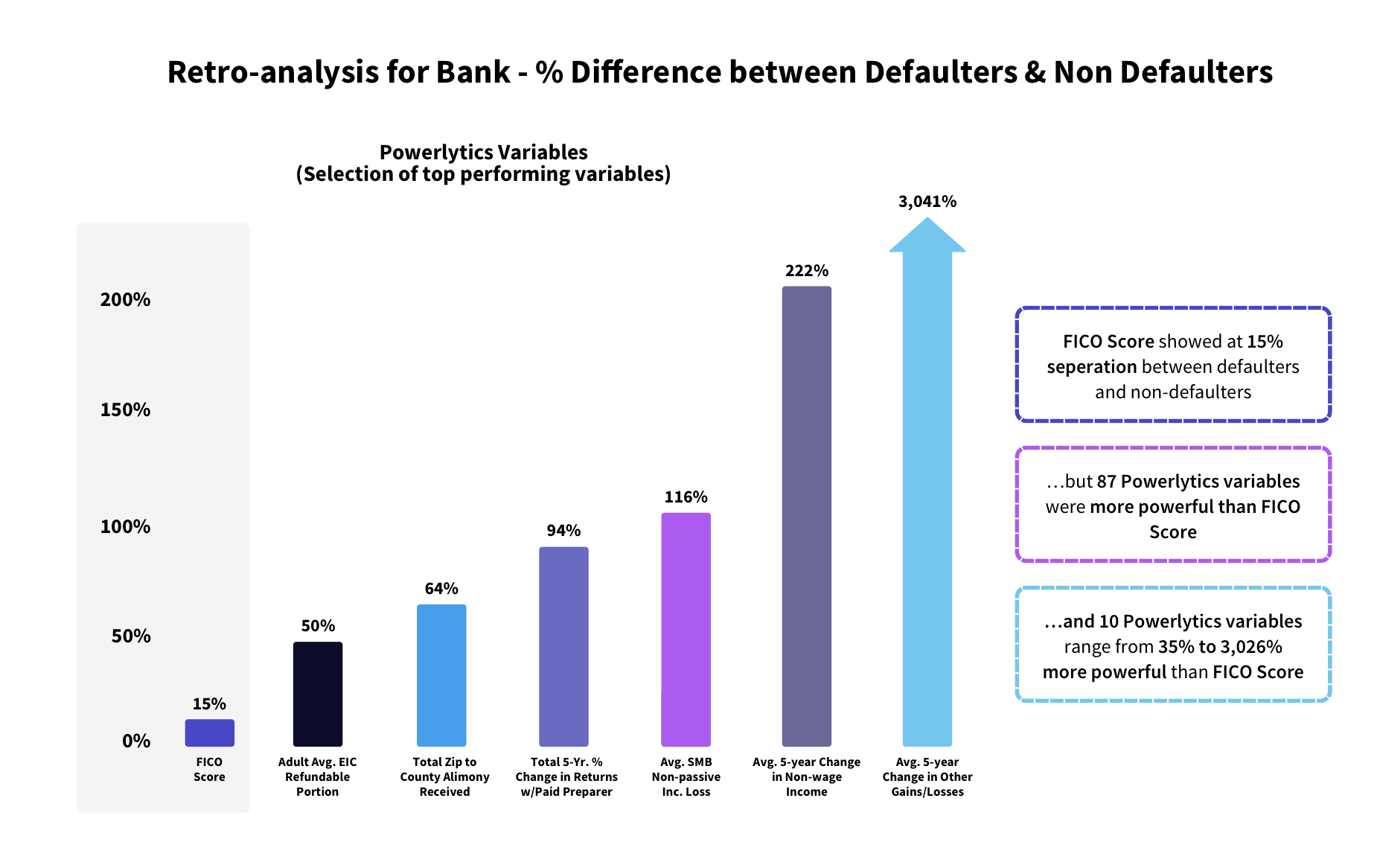

A US based financial lending institution sought to sharpen its ability to identify good credit prospects who could be quickly approved for a loan vs. those consumers who were more likely to default and may require deeper analysis.

By combining Powerlytics Data Platform with the financial institution’s customer loan data, we were able to identify the consumer tax return variables that have significant predictive power between the default and non-default populations.

Once the Powerlytics variables are identified, they can be leveraged in predictive models, scores or indexes for a variety of reasons that include but are not limited to the following:

The Powerlytics variables showed significantly more accurate predictive power when compared to the customer’s FICO Score.

Specifically, Powerlytics had 46 tax variables that are more powerful than the FICO Score for separating consumers that default from consumers that do not default.

The Top 10 Powerlytics variables range from 35% to 3,026% more powerful than FICO in predicting consumers that default from consumers that do not default.

Please note that the average differences above are across multiple FICO Score bands and income ranges. For example, the average difference of the FICO score for defaulters vs. non-defaulters was 15% while the average different between those populations for the Powerlytics variable “Average 5-year Change in Other Gains/Losses” was 3,041%.

In other words, the Powerlytics data variable was over 200 times more predictive (3,041%/15%) than the FICO score.

Helping Banks and Lenders Improve Portfolio Risk Analysis in a Recession

Read Article